what percent of taxes are taken out of paycheck in indiana

These are the rates for. What is the tax rate for Indiana.

Paycheck Taxes Federal State Local Withholding H R Block

What is the percentage that is taken out of a paycheck.

. How Your Indiana Paycheck Works. Just enter the wages tax withholdings and other information required. Indiana Hourly Paycheck and Payroll Calculator.

What percentage of my paycheck is withheld for federal tax 2021. FICA taxes consist of Social Security and Medicare taxes. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

Indiana Hourly Paycheck Calculator. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. As an employer you must match this tax dollar-for.

FICA taxes are commonly called the payroll tax. 10 12 22 24 32 35 and 37. 10 12 22 24 32 35 and 37.

185 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. The State of Indiana website posted a complete list of 2021 tax rates. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

For a single filer the first 9875 you earn is taxed at 10. The amount of federal taxes taken out. Indiana State Payroll Taxes Its a flat.

How much is payroll tax in Indiana. This Indiana bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Federal income taxes are paid in tiers.

Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This 153 federal tax is made up of two parts. Total income taxes paid.

The federal withholding tax has seven rates for 2021. How much money do they take out your paycheck. Your bracket depends on your taxable income and filing status.

To use our Indiana Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 081 average effective rate. The federal withholding tax.

Total income taxes paid. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel. However they dont include all taxes related to payroll.

After a few seconds you will be provided with a full breakdown. Amount taken out of an average biweekly paycheck. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

Social Security has a wage base limit which for 2022 is. 124 to cover Social Security and 29 to cover Medicare. Need help calculating paychecks.

There are seven federal tax brackets for the 2021 tax year. 323 Indiana has a flat state income. The Indiana bonus tax percent calculator will tell you what.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Indianas statewide income tax has. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Payroll Tax Calculator For Employers Gusto

Indiana W4 Fill Out And Sign Printable Pdf Template Signnow

Dearborn County Income Tax Increase Now In Effect Eagle Country 99 3

It S Tax Time Southern Indiana Extol Magazine

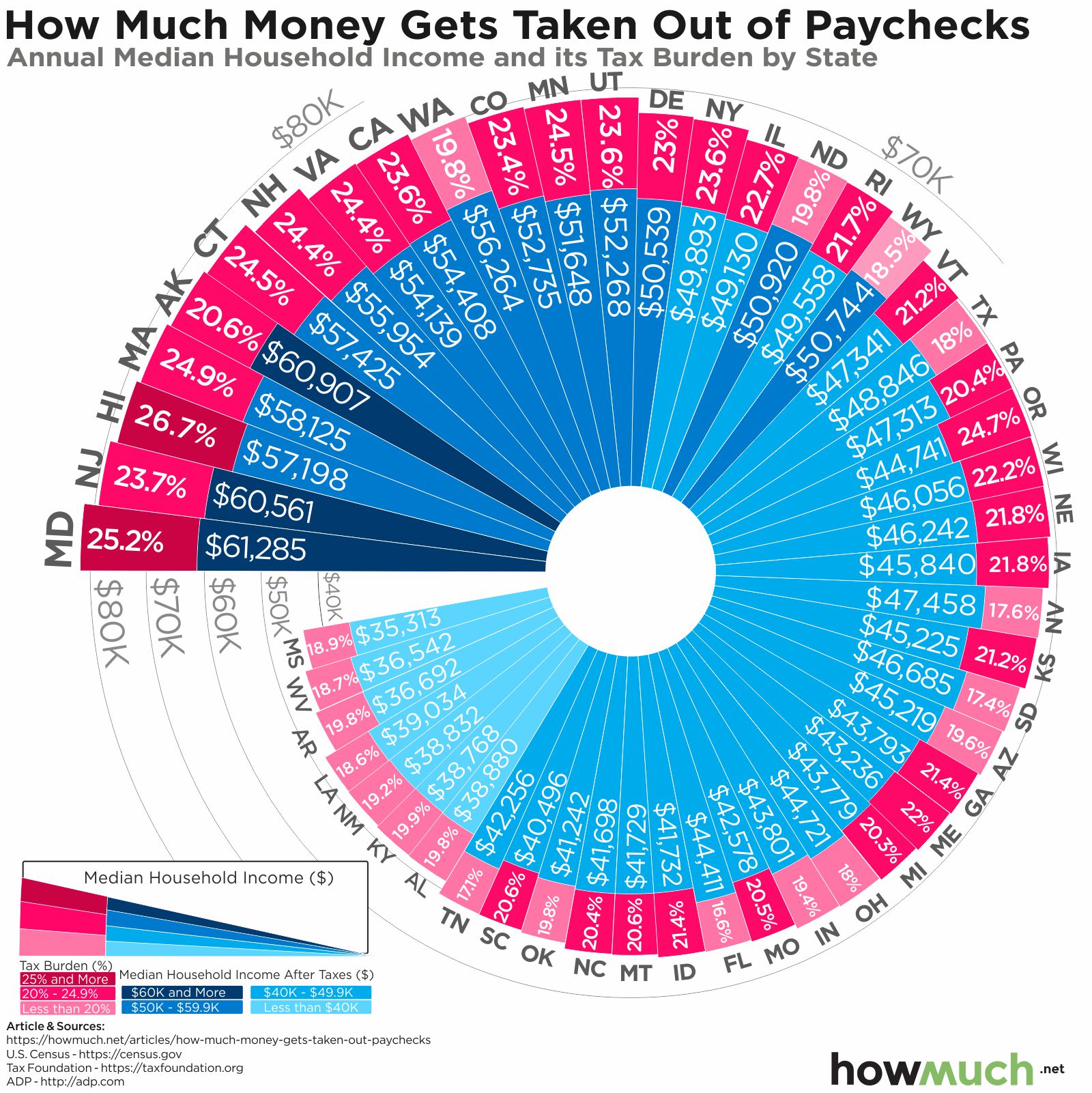

Visualizing Taxes Deducted From Your Paycheck In Every State

State Conformity To Cares Act American Rescue Plan Tax Foundation

Indiana Democrats Propose More Immediate Tax Relief For Hoosiers

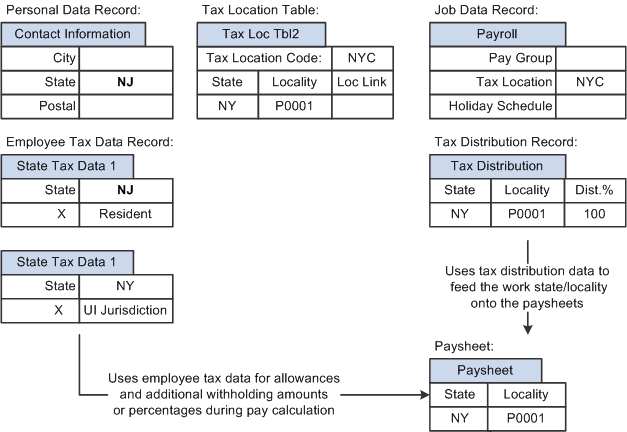

Peoplesoft Payroll For North America 9 1 Peoplebook

Indiana Paycheck Calculator 2022 2023

Indiana Income Tax Calculator Smartasset

2022 Federal State Payroll Tax Rates For Employers

Indiana Judicial Branch Office Of Judicial Administration Instructions For Online Pay Stubs

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Irs Provisions Followed Not Followed By Indiana Somerset Cpas And Advisors

Indiana Retirement Tax Friendliness Smartasset

New York Hourly Paycheck Calculator Gusto

Indiana Paycheck Calculator Adp